In the era of globalization and escalating global competition, simply offering high-quality products or services is no longer sufficient to maintain a competitive edge in business. Indeed, effectively analyzing and interpreting data from the market has become crucial for companies. In this context, business intelligence (BI) has become an essential resource for companies seeking B2B customers. In fact, BI, i.e., the set of tools, practices, and processes used to collect, analyze, and integrate data into business strategies, has the potential to radically transform companies’ approach to the market, enabling a deep understanding of data and providing valuable insights that can guide strategic decisions and improve operational efficiency.

Therefore, this article will focus on the importance of data, the crucial role that big data and small data play in business intelligence, and how VisionSphere exploits the latter to help companies find B2B customers.

Big data and small data

The history of data in the corporate world is full of evolutions and transformations that began when the first companies started collecting information to support their strategic decisions. Organizations initially relied on manual methods and rudimentary storage systems to manage their data. However, with the advent of technology and the explosion of the digital age, the landscape has begun to change dramatically.

Indeed, the modern era is characterized by an abundance of data, both structured and unstructured, generated from various sources such as business transactions, online interactions, and social media. That is how the concept of big data was born.

Big data are enormous volumes relating to the present but, above all, to the past, which require advanced technological solutions for their management, analysis, and use. This data, characterized by the speed and continuity with which it is created, as well as its variety and large volume, offers companies significant but massive information, allowing them to identify market trends and customer behavioral patterns and optimize business operations on a large scale.

On the other hand, small data, as the term suggests, refers to specific, detailed, unique data.

This concept emerged in response to the growing emphasis on big data and the need to better understand specific and detailed information about individuals and individual cases. The term has gained popularity over the last twenty years or so as companies have begun to realize the importance of analyzing more specific and focused data to gain a competitive advantage.

In fact, these data are real clues that provide targeted and individual information relating to each potential customer. From a commercial perspective, they provide insights into the needs and interests expressed. Small data can also be easily understood and interpreted by humans, unlike big data, which, as we have seen, requires technological tools and resources to be processed.

In this context, the integration and complementarity between small and big data becomes crucial. While small data provides detailed and meaningful insights at the individual level, big data enables large-scale, predictive analytics, opening up new opportunities for innovation and business growth. Starting from these peculiar differences, we want to analyze small data in detail to understand their strategic potential for finding B2B customers.

Small data: strategic data

Starting from these peculiar differences, we understand that small data can be important clues about the present, capable of revealing how the future could evolve. This data, focused on the quality and depth of the information, allows companies to understand the current needs better and, at the same time, the future actions of their prospects and B2B customers, allowing for more targeted customization of marketing and sales strategies. Small data, therefore, offers a detailed focus on the behavior and needs of B2B customers, allowing companies to identify business opportunities and provide customized solutions that respond to the specific needs of the market, prospect, or customer.

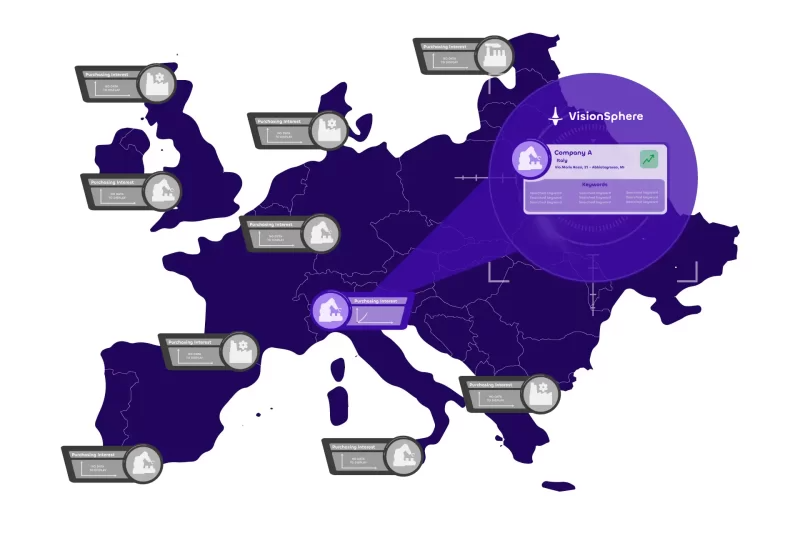

In this context, VisionSphere presents itself as an essential business intelligence tool for all B2B companies that need an easy and always-ready tool to collect small data to fully exploit its potential in finding B2B customers worldwide. Thanks to its ability to collect, analyze, and interpret Web data effectively and in real-time, VisionSphere provides companies with valuable insights to help them find new B2B customers and, at the same time, guide them in making strategic commercial and communication decisions.

How VisionSphere exploits small data

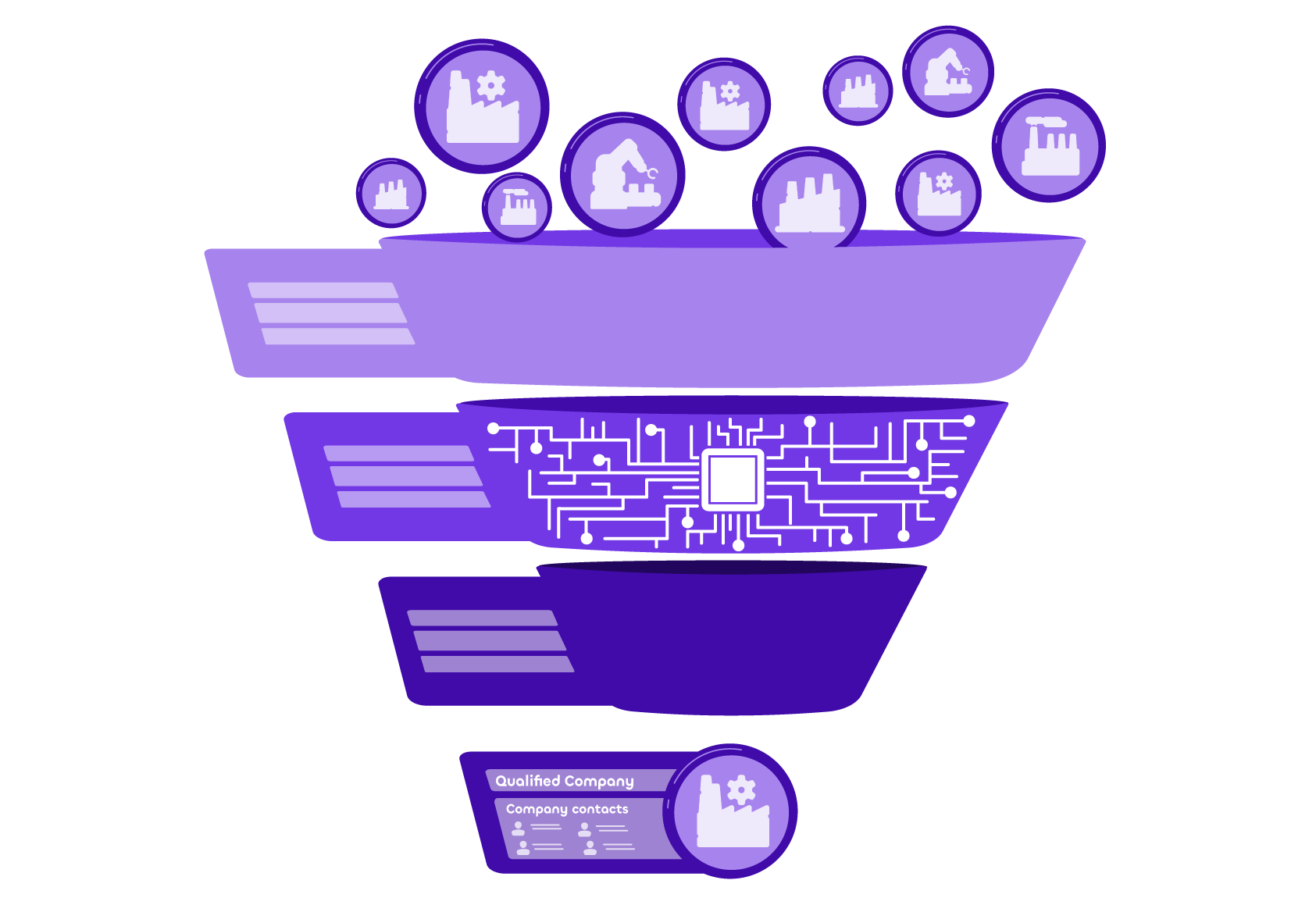

As anticipated, VisionSphere is a Business intelligence tool that exploits the power and precision of small data to qualify concrete commercial opportunities by helping companies find new customers in B2B. Let’s see how.

By constantly monitoring the online activities of companies of interest, VisionSphere can determine when and which business opportunities are close to being purchased. VisionSphere intercepts the searches that companies conduct online and extrapolates fundamentally valuable information from this structured data. By reprocessing this data (small data), VisionSphere defines the degree of involvement of a B2B company. Defining the level of participation on a daily basis can help companies constantly monitor the market to define qualified commercial opportunities (interested in purchasing the product or service offered), thus actively supporting companies in their search to find new B2B customers.

To make its operation more straightforward, we can see an analogy in the interest expressed by a B2B company before and after the purchase with a Gaussian curve. The growth of the curve graphically represents the number of searches carried out online by this company over time concerning a topic of interest, such as a product or service necessary to satisfy a company need (respectively on the ordinates the number of searches and the x-axis the time).

As we can see in the figure, the initially low interest (“1” in the figure) is represented by the few searches carried out online by the company in the attention phase of the AIDA funnel. As time progresses, however, we can see how searches and, therefore, interest grow almost exponentially as soon as the company enters its interest phase. That happens because, in structured companies, purchasing decisions are made by a purchasing system, a group of people with the tools and experience necessary to evaluate market offers and choose the best option to benefit the company the most.

Therefore, searches initially carried out by a few people, if not just one, activate VisionSphere, which intercepts them and begins to collect the data generated by that company; if the purchase urgency is high, then the purchasing system will start to carry out a progressively greater number of searches (“2″ in the figure), more frequently and will dedicate more time to analyzing the results, thus bringing the company into the desire phase. In this scenario, in the Gaussian curve, we see an increasingly steep growth in shorter times, which culminates at its peak with the purchase in the action phase (“3″ in the figure) and then fades and returns to the floor level shortly after.

Business intelligence tools, whether they exploit small data or big data, cannot provide insights into the present without analyzing data from the past. VisionSphere, on the other hand, exploits the small data of the present, the searches that companies do on search engines in real-time, to define the future evolution of the interests of the monitored companies.

VisionSphere’s functionality of intercepting searches as they are made allows companies to project themselves into the future to “anticipate” their needs by helping them find new B2B customers. This operating principle will enable companies to act before anyone else, especially the competition, to make profitable commercial decisions.

VisionSphere is, therefore, a fundamental tool for the commercial department of a company interested in finding new customers in the B2B world. By intercepting the interest of the potential customer company at the beginning of the Gaussian curve, i.e., already at the beginning of the first exploratory phase of the purchasing process (attention phase of the AIDA funnel), VisionSphere allows B2B companies to anticipate the needs of their potential customers, proactively coming into contact with them in the most involved phase of the purchasing process.

Conclusion

In an increasingly competitive and globalized industrial and commercial landscape, business intelligence (BI) proves essential to maintaining an advantage in the B2B context. VisionSphere, as a BI tool, precisely leverages small data to help companies find new customers in the B2B world. Its ability to monitor companies’ online activities allows you to anticipate their needs and adopt proactive strategies to meet market needs. In this way, VisionSphere positions itself as a strategic ally for B2B companies, enabling them to quickly adapt to changing market dynamics and drive their business success into the future.